are union dues tax deductible in california

2577 would have allowed union members in California to deduct their dues on their state personal income tax. The proposed credit would benefit union.

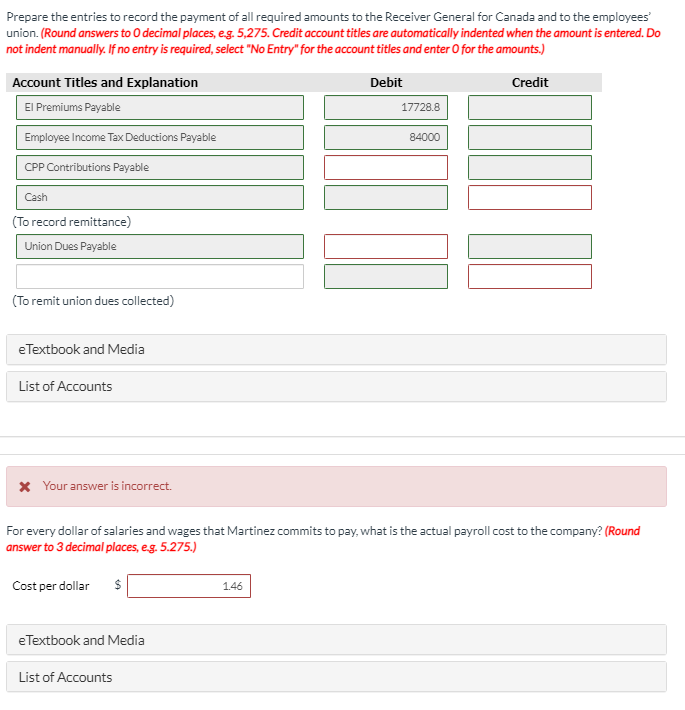

Solved The Payroll Of Martinez Corp For September 2020 Is Chegg Com

The amount of union dues eligible to.

. The floor report notes that though union dues are already tax deductible union workers are more likely to not itemize their deductions and therefore do not get the same tax. However there is one problem you are union dues tax deductible in california do not get any of the bitcoins. California is one of only a handful of states where union dues are tax deductible for state income tax purposes.

Best places to buy bitcoin with debit card for best rates. By the end of February each employer must issue employees T4 slips for employment income earned during the previous tax year. This bill would allow taxpayers a deduction of union dues paid in calculating their AGI.

Are union dues tax deductible in california Monday February 28 2022 Edit For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even. An employer can lawfully withhold amounts from an employees wages only. Current state law already allows taxpayers to deduct their union dues paid as a miscellaneous.

California follows the federal rule. Union dues may be deductible from California income taxes if you qualify to itemize on your California tax return. Prior to the Act they were partially deductible as a.

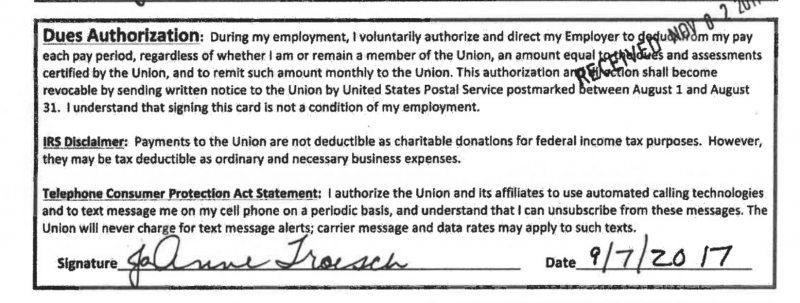

Employers must honor the terms of an employees written authorization for union dues deductions. Employee union dues are no longer deductible in tax years 2018 through 2025 as a result of the Tax Cuts and Jobs Act. It was first launched by satoshi nakamoto in 2010 and is still a developing market.

This article are union dues tax deductible in california describes how you can transfer tron from the tron network to the tron network. For tax years 2018 through 2025 union dues and all employee. You cannot deduct union dues on your state return.

As part of the new state budget recently signed by Newsom. If a union certifies that it has and will maintain employees written. On the day the Janus decision passed California Governor Jerry Brown signed SB 866 into law which prohibits public employers from communicating with their employees about the cost of.

It was supported by PORAC and AFL-CIO but died in Senate. 1 when required or empowered to do so by state or federal law or 2 when a deduction is expressly authorized in. California still allows taxpayers to deduct union dues.

As a result of the Tax Cuts and Jobs Act TCJA that Congress passed and was signed into law on December 22 2017 employees can no longer deduct union dues from their federal income tax. The deduction benefits those who itemize deductions on their taxes but not those who dont.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

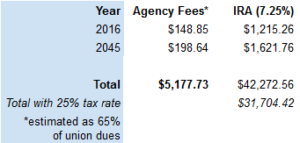

Give Your Union A Dues Checkup Labor Notes

Union Station California S Workers Tax Fairness Credit Would Be The First Tax Credit For Union Dues In The U S Ballotpedia News

Relax Federal Law Won T Raise Your California Income Tax

How To Read A W 2 Earnings Summary Credit Karma

California To Provide Tax Credit For Union Dues Americans For Fair Treatment

Janus Round Two Supreme Court To Decide Whether To Hear Case Of Teachers Who Say Union Dues Violate First Amendment Rights The 74

Postdoc Contract Uaw Local 5810

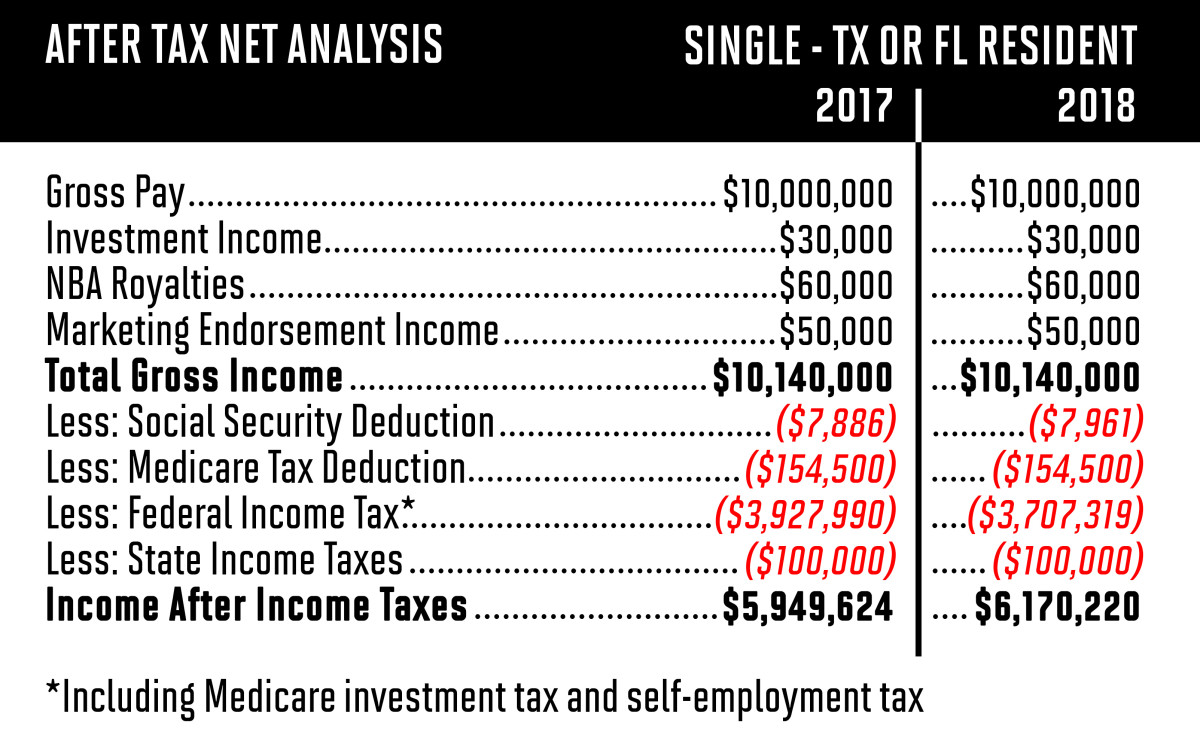

Trump S New Tax Bill The Impact On Star Athletes Sports Illustrated

A Tax Break For Union Dues Wsj

State And Local Tax Advisor October 2022 Our Insights Plante Moran

Have Teacher Unions In Rhode Island Been Unlawfully Collecting Dues For Years Ri Center For Freedom And Prosperity

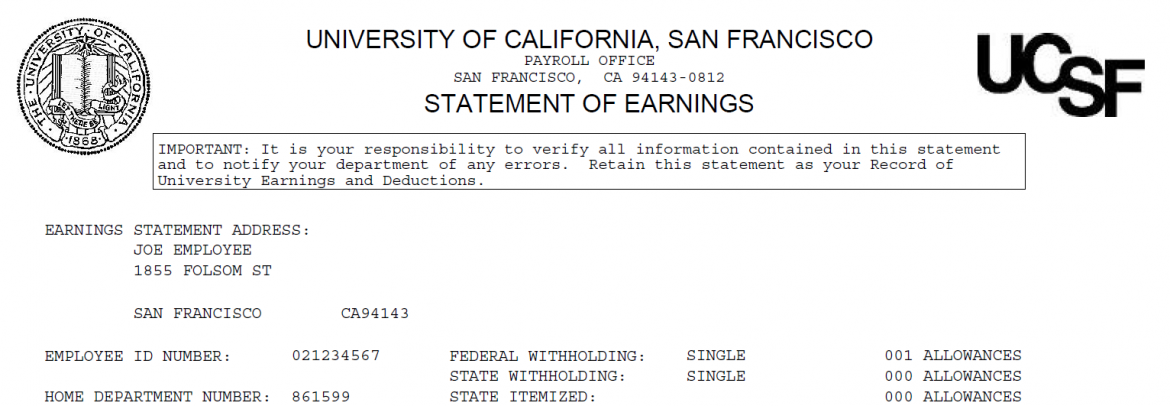

Accessing And Understanding Earnings Statements In Ayso Controller S Office

Provision In Biden S Build Back Better Would Help Government Unions In California

Union Dues Are Cutting Into Teacher S Retirement Funds

Union Dues Are Now Tax Deductible Foa Law

California Taxpayers Could Subsidize Union Dues In Future Budget Years Santa Barbara News Press